This is a Guest blog post from Andre Averbug, an entrepreneur, economist, and writer who has been helping entrepreneurs prepare for their investor pitches for several years.

0. Title

Before the content slides, you need a slick title slide to catch people’s attention from the get-go. Include your company logo/name and perhaps a great picture that represents your mission or broader vision. I like it when companies also include a short sentence, such as a slogan or value proposition, that already gives the audience an idea of what the company is about. Mint’s title slide from its 2007 pitch is a great example.

1. Problem

Every startup should be focused on solving a particular problem – big or small. The first slide is the place where you explain what the problem is with facts and numbers. For ex, Breakthrough, a company that provides mental health services, laid out a clear problem statement that set the stage for why its business mattered. You can also focus the discussion of the problem on a typical customer or beneficiary, to make it more personable (“Mr. Smith has mental health problems, but he doesn’t feel comfortable sharing his illness with others and seeking help…”)

2. Solution

After the problem, of course, comes the solution. What is your company doing to solve the problem? This could be framed as a value proposition or the company’s broader vision but should also include specifics as to how your product or service is making people’s lives better. Gleamr, an app that provides professional auto detail on-the-go, laid out its solution very clearly.

3. Product / Service

Now is the time to describe in detail how your product or service works. Include screenshots, images, graphs, anything that helps the audience understand what is it that you’re offering. If the product is not ready yet, include pictures of the prototype or wireframes. If you provide a service, include a simple schematic showing how the service works. The example below is from Airbnb’s first pitch deck.

4. Business Model

Every investor will need to know how you plan to make money with your business. Explain how much you are charging your clients, for which offerings and, if other partners are involved, who takes how much of the profits. Gleamr makes it all very clear with a simple infographic.

5. Market Opportunity

How big is the potential market for your product or service? How many people in your country, region or even world could become paying customers? Talk about your target market, their overall characteristics and preferences. Learn about the concepts of TAM, SAM and SOM. Airbnb’s example below is good, but I personally prefer to present market size figures in dollars. Therefore, I would multiply the 84 million SOM (share of market) by the average amount charged for a trip (for ex, if the average trip is $100, total SOM would be $8.4 billion).

6. Marketing

You need to show investors you have a clear plan to attract and retain customers. What is your go-to-market strategy? How will you reach out to potential customers? Will you use social media, paid ads, attend conferences, blog etc.? Gleamr actually went beyond and included information on “staying competitive”, with insights about product development – however, in most cases, focusing on marketing and sales and saying a few words about keeping customers is enough.

7. Competition

Who are your (direct and indirect) competitors? Never say you don’t have any, it is simply not true! How do you differ from them? What is your competitive advantage? To convey the message in a clear way, many companies use graphs plotting down competition across different axes (e.g.: price, quality, speed, customer experience) or a table that compares specific features across products.

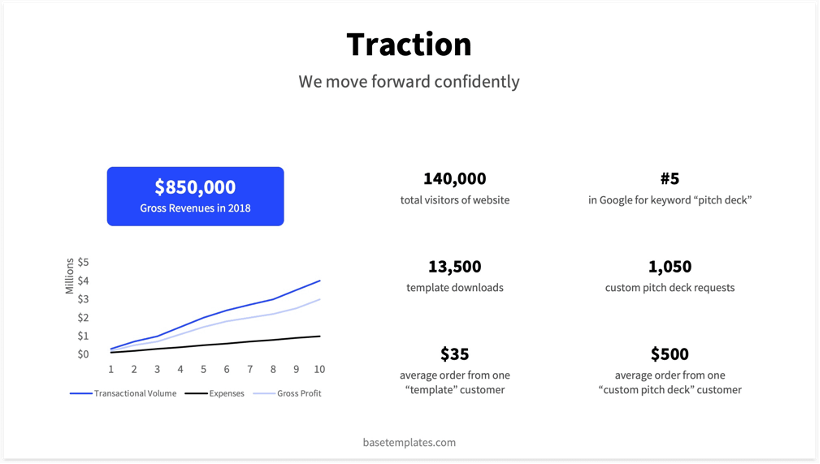

8. Traction (and/or Financials)

What have you accomplished so far? Let numbers tell the story. How many active users and paying customers do you have? How much revenue? Have you broken even yet? What is your EBITDA margin? If you’re very early stage, what partnerships have you developed? Have you won any relevant award (e.g.: innovation, product development)? Have you been selected to an accelerator/incubator? Do you have an MVP? Have you run a successful pilot and, if so, what were the results?

9. Team

Many investors bet more on the jockey (i.e., entrepreneurs) than the horse (i.e., company). But even if they don’t, you need to show them you are the best team out there to execute this wonderful business plan. Include up to 5 people maximum and be sure to use nice pictures and include short bios in bullets. This is a good time to share your passion for what you’re building and talk about how great you complement each other and work together.

10. Financial Projections and Ask

Finally, it is time to show what you plan to accomplish in the next few years and what you need to get there. Include a table or graph showing your financial projections (revenues and EBITDA or net income should suffice for a short pitch) for the next few years – I personally stop believing in year 3. Explain how much money you need to reach your goals. Include a use-of-funds table or pie-chart, such as the one below, to show exactly how you plan to spend the funds you’re raising.

Finally, if you didn’t have your contacts and company website at the bottom of each slide, you might want to wrap up the presentation with a “Thank you!” slide including contact information.

The slides above and their order are of course suggestions only. The ultimate number and content of slides are dependent on the time available to present, whether you are presenting in an event with multiple companies and investors or to one investor only, if the audience already knows your business, among other factors. In any case, I consider these ten pieces of content to be the backbone of most investor pitches.

Good luck!

Image: freepik.com

Andre Averbug is an entrepreneur, economist, and writer. He has over two decades of international experience working in the intersection of economic development, entrepreneurship, and innovation. He has worked and lived in multiple countries across North and South America, Europe, Africa, and Central Asia.

Andre has started and run four startups, in Brazil and the US, and was awarded Global Innovator of the Year in 2009 by World Bank’s infoDev. He has extensive experience supporting companies as mentor and consultant, both independently and as part of incubators such as 1776 and the Kosmos Innovation Center, and programs like Shell LIVEWire, StartUp Weekend and WeXchange.

As an economist, Andre has worked in topics ranging from innovation ecosystems, entrepreneurship and MSME development policy, competitiveness, business climate, infrastructure finance, monitoring and evaluation (M&E), and country assistance strategy for the World Bank, the Inter-American Development Bank (IDB), and the Brazilian Development Bank (BNDES). He has also consulted for clients such as DAI Global, the Economist Intelligence Unit (EIU), TechnoServe, among many others. He holds a master’s degree in economics from the University of London (UK) and an MBA from McGill University (Canada). Andre lives in the Washington, DC area.

He writes an awesome Blog called Entrepreneurship Compass and you can sign up here: https://entrepreneurshipcompass.com